MLVizz Reduces Large Teams of Analysts & Engineers, with Agentic AI-Driven Data Intelligence.

Whether you're in banking, insurance, or any industry, MLVizz adapts to your data & business needs.

Seamlessly works with SQL databases, Snowflake, Synapse, Feast Feature Store, CSV, AWS, Databricks, & other data formats.AI-based relationship detection.

Directly connect with models built in Google Cloud AI, Microsoft Azure Machine Learning, & AWS SageMaker, ensuring consistency & up-to-date data representation.

Seamless Integration

Secure & Versatile

MLVizz can be deployed onto private cloud architectures and works with all open source, commercial models and public cloud providers.

Time Saving & Business Efficiency

Our AI automation cuts down on the traditional time-consuming process of data. This work normally done by experienced data engineers, can now be performed in minutes instead of weeks.

The effect is to streamline workflows, allowing teams to focus on strategic tasks & alignment with business goals rather than plough through complicated dataset joins & data discovery processes.

MLVizz uses trained AI models & an LLM to automatically detect & infer relationships between disparate datasets. LLMs are used to join datasets lacking a foreign key, based upon text data.

Superior Model Performance - The auto relationship generator & AI powered feature generation leads to richer features, improving model accuracy & predictive power.

Relationship Detection

MLVizz is an advanced agentic AI data analysis & integration solution that provides faster delivery of AI projects & solutions. Save time, costs & improve efficiency with automated data analysis, lightning-fast data migration, insight-driven dashboards & expert data quality using machine learning & artificial intelligence.

Automated Data Analysis & Relationship Detection

Connect, unify, & analyse your data in minutes. MLVizz’s AI handles the heavy lifting of integration, analysis, and enrichment, so your teams can act faster.

AI-based relationship detection

Secure legacy system data migration

Auto-generated features for ML

Supports structured & unstructured data.

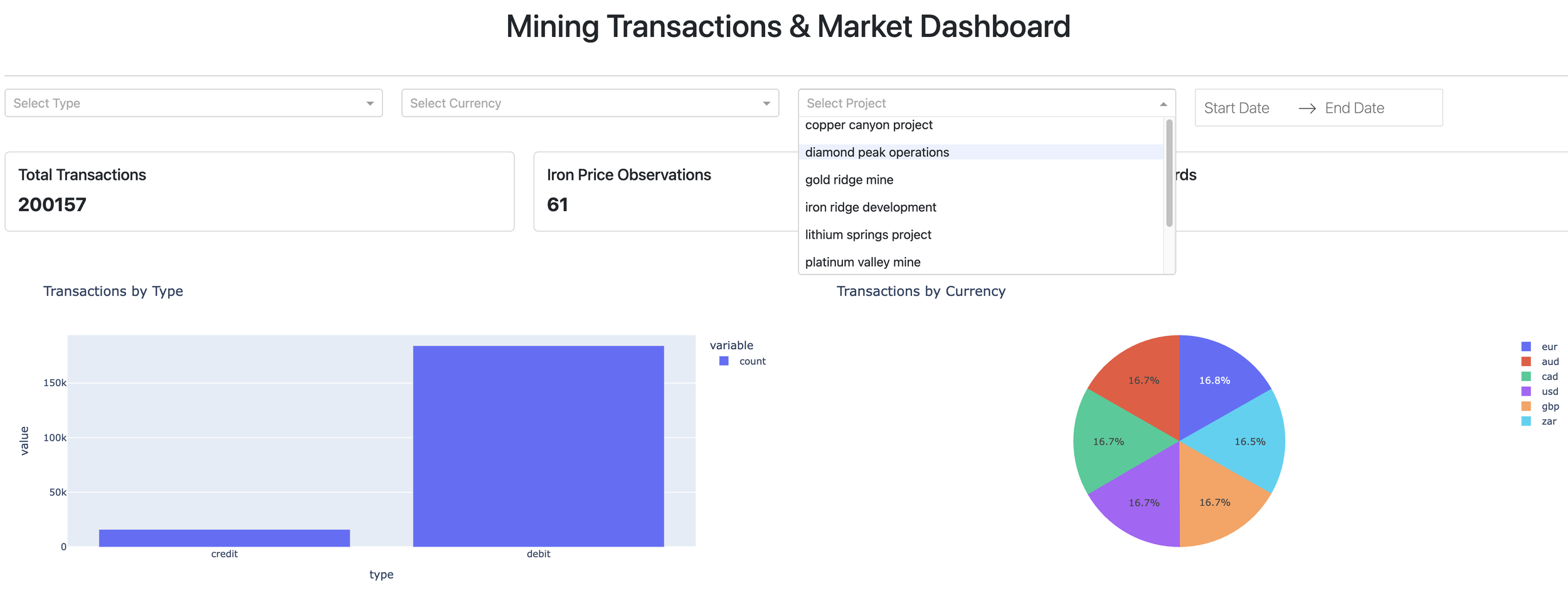

No-Code Data Modelling & Dashboards

From raw data to rich visuals—MLVizz delivers no-code data modelling and dashboarding that reveals the “why,” not just the “what.”

AI-powered insights with zero code

Dashboards tailored per customer or user

Agentic visualisation with built-in recommendations

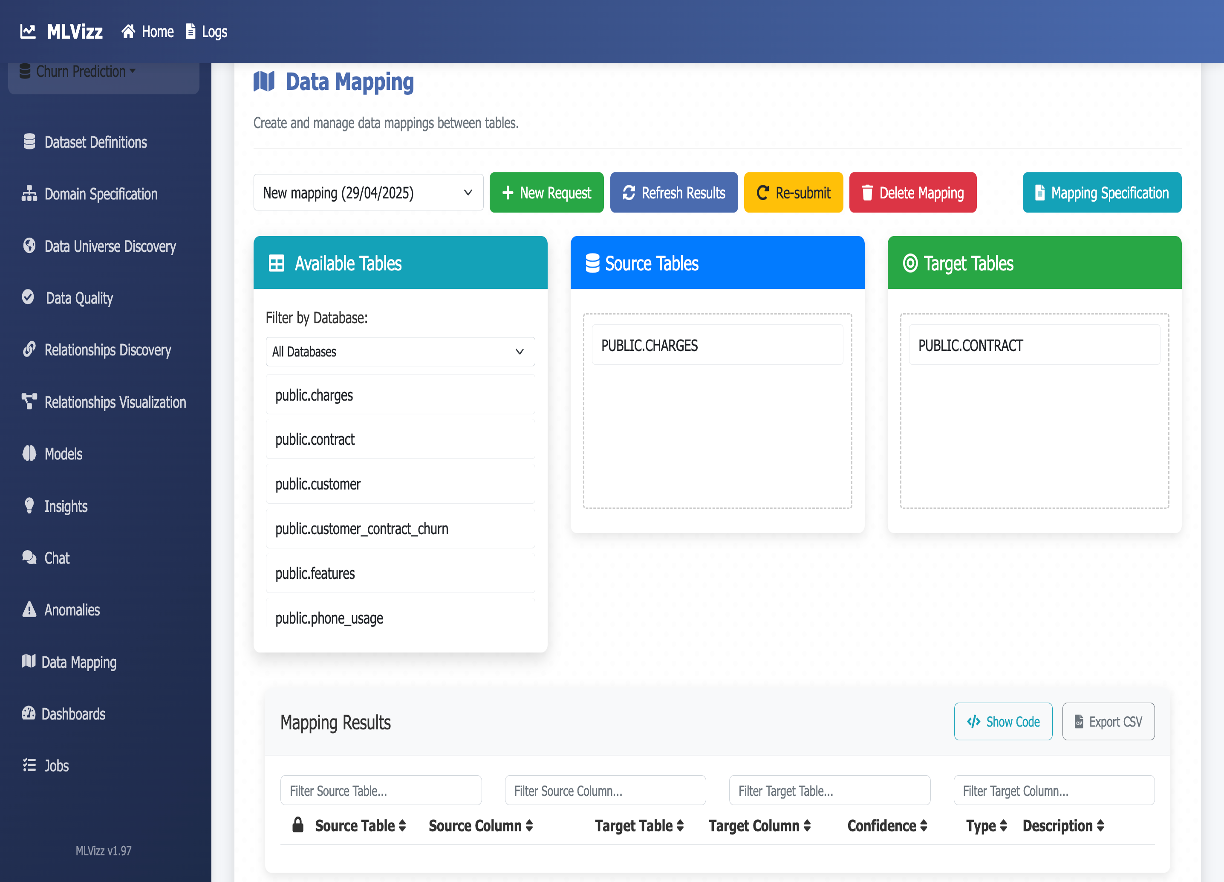

Data Mapping & Automated Migration

Traditionally, analysts or engineers would write SQL or ETL scripts to join source and target tables.

Mapping logic has to be documented and manually updated every time schemas change.

With MLVizz:

Users can define source-target mappings visually using a drag-and-drop interface.

The system automatically identifies column-level relationships with confidence scores.

Mapping specifications can be exported or resubmitted instantly.

Updates are easy to manage with minimal technical effort.

This feature allows users to define & manage data mappings between source & target tables. Key features include:

Selecting source and target tables from available datasets

Viewing and editing mapping results, including column-level relationships

Generating mapping specifications, re-submitting or exporting mappings as needed.

This ensures accurate data integration & transformation for downstream analytics & modelling.

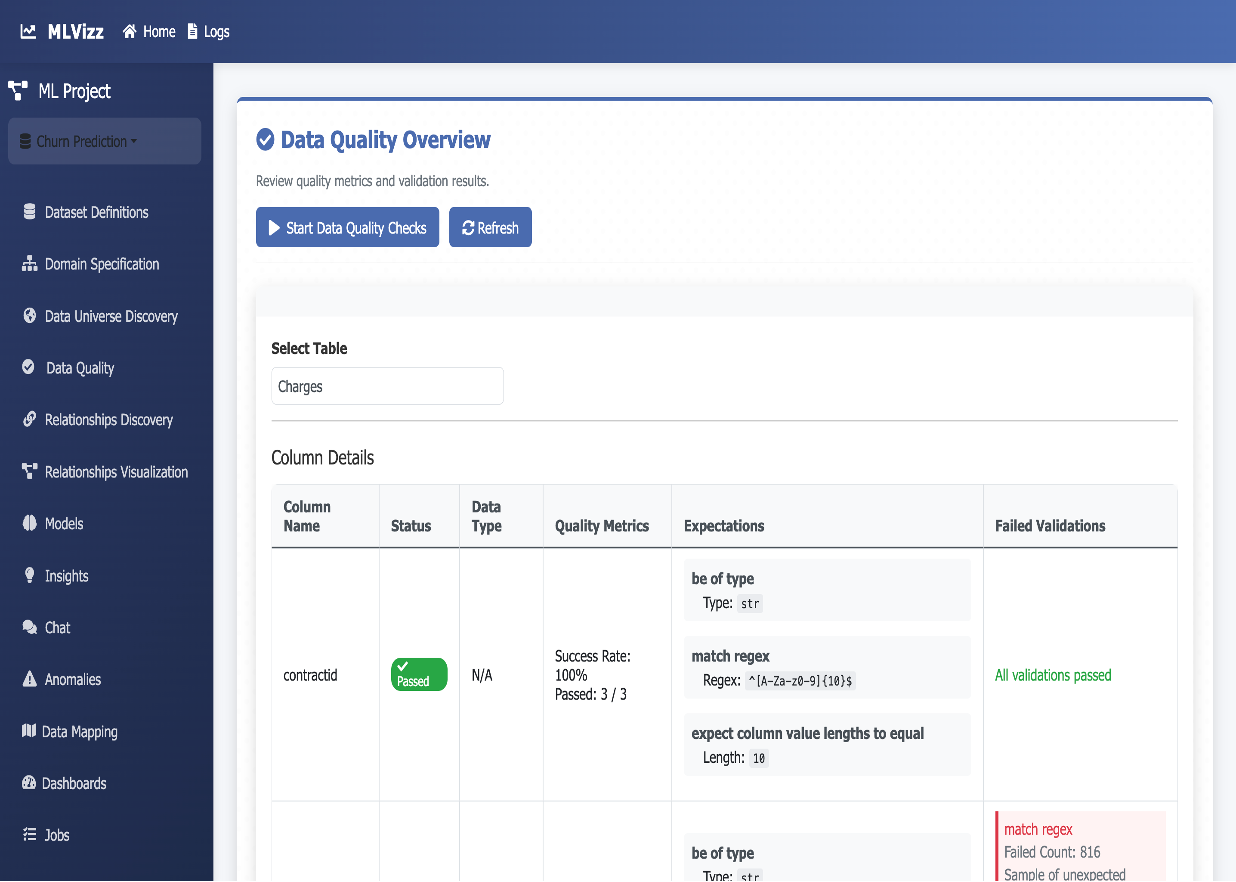

Data Quality

Normally, analysts would need to write custom SQL or Python scripts to:

Validate data types, formats and lengths

Calculate success/failure metrics manually

Validate business rules like gender, Pincode, and null values etc

With MLVizz:

Users select tables and initiate checks with one click via the UI

Agentic microservices validate each column against rules (e.g., type, length)

LLM-assisted quality agents interpret metadata and auto-apply expectations

Validation outcomes, error summaries, and metrics are displayed instantly using REST APIs + UI layer

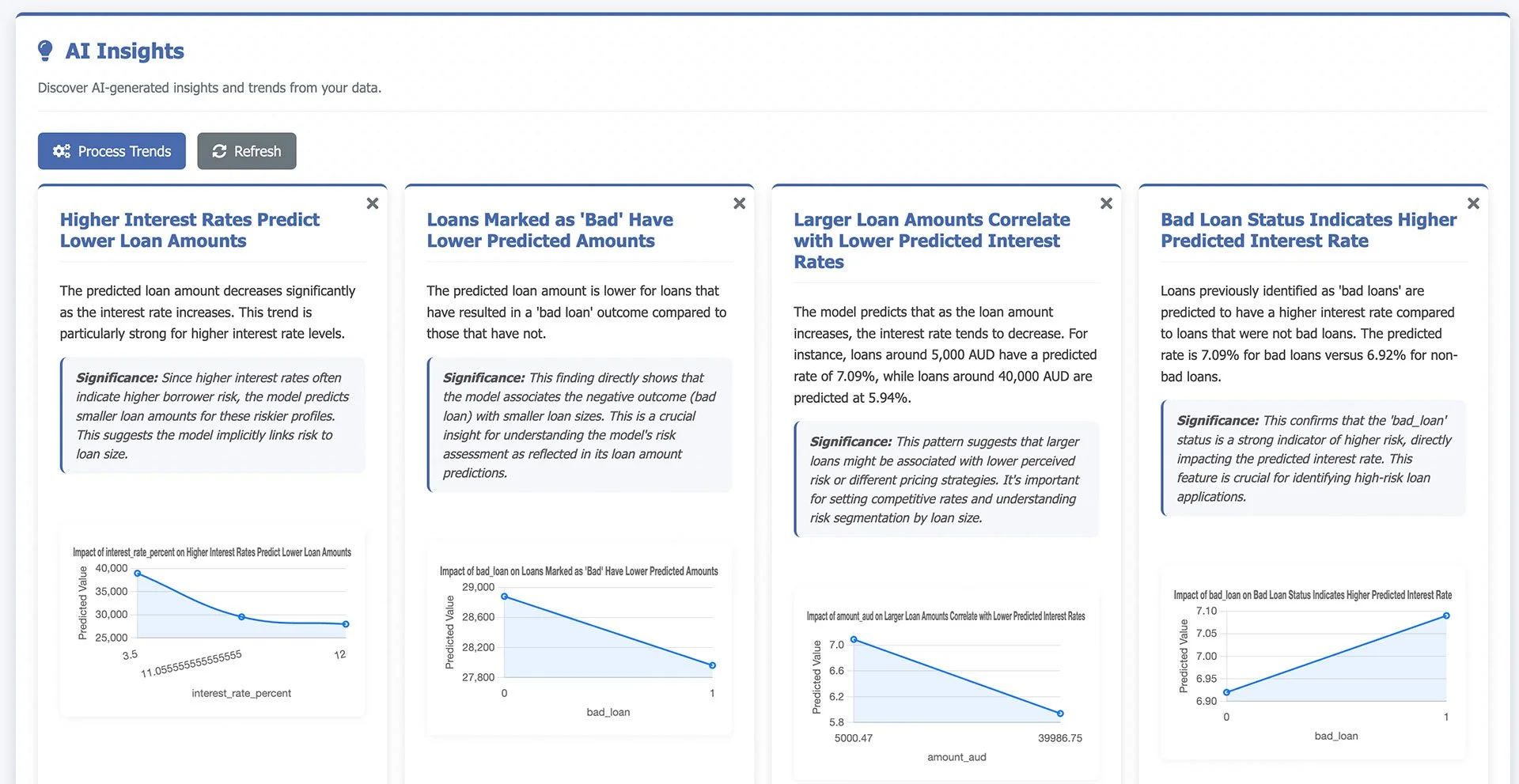

AI Insights

Manually identifying patterns in data (like non-linear trends or hidden correlations) requires expert analysis, feature engineering, and time-consuming exploration using statistical tools or code-heavy scripts. Business teams struggle to extract meaningful insights without dedicated data scientists.

With MLVizz:

MLVizz automates insight discovery using LLM-powered Agentic Microservices and an Inference Engine.

It scans your dataset, detects hidden trends, and generates easy-to-read summaries and visual explanations, all with zero coding.

The AI Insights page presents automatically generated insights and trends identified by AI from the dataset.

Key highlights include:

Identification of patterns, such as non-linear relationships in customer charges

Clear explanations with significance notes to support business decisions

Visualizations accompanying each insight for better interpretation.

This helps stakeholders quickly understand important factors e.g. items influencing churn and revenue.

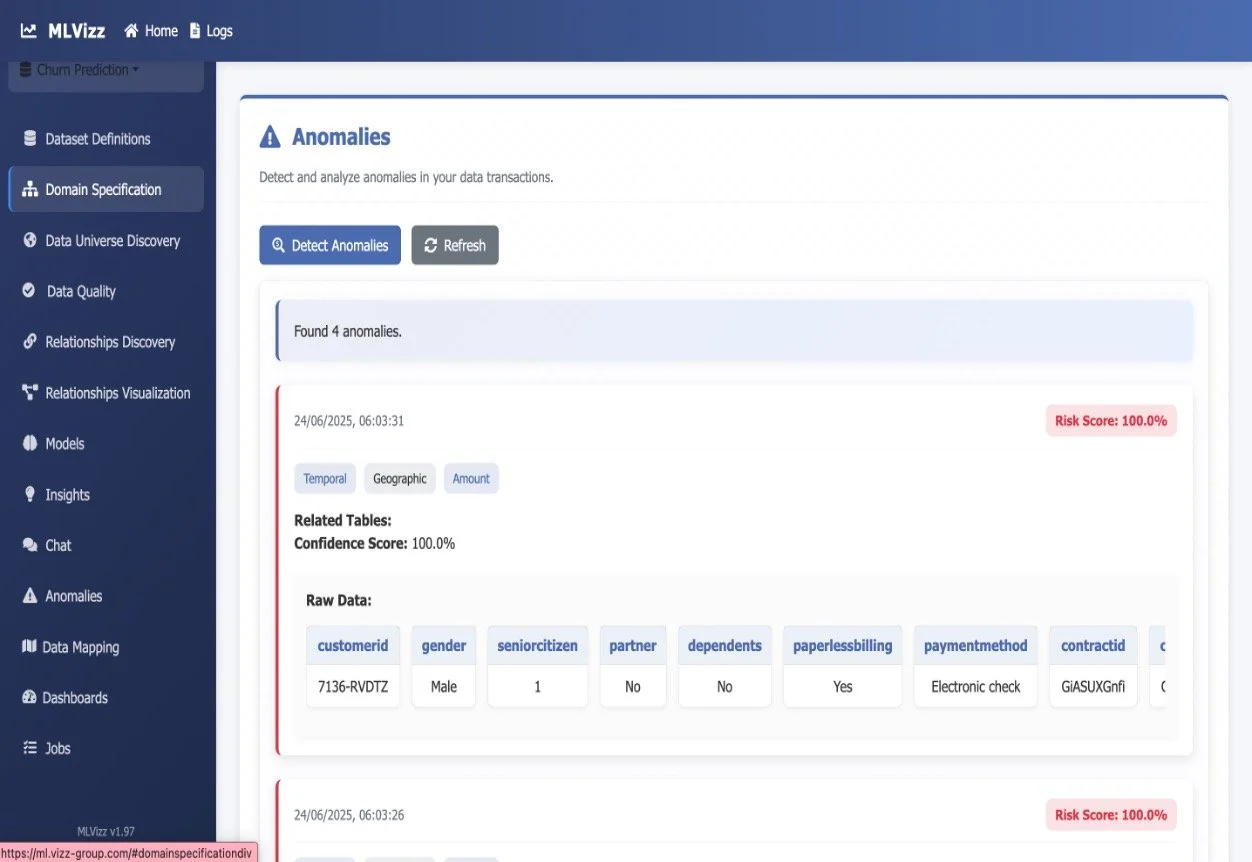

Anomalies Detection

You no longer need to write SQL queries or Python scripts to monitor data. No need to manually define thresholds for different variables (e.g., transaction amount > $X). The days of constant tuning and revalidation are over.

With MLVizz:

AI agents automatically scan data across multiple dimensions (temporal, geographic, and monetary).

Risk scoring and confidence levels are generated instantly.

Raw anomalies are clearly visualised with contextual metadata.

No coding or rule-setting required—just click Detect Anomalies.

The anomalies page identifies and displays unusual or unexpected patterns in your dataset.

Key features include:Detection of anomalies across dimensions like time, geography, and transaction amount

Display of detailed raw data for each flagged case

Confidence scores and risk levels to assess severity (e.g., Risk Score: 100%)

This functionality helps uncover potential fraud, data entry issues, or operational outliers.

Industry Use Cases:

-

A major, leading bank leveraged MLVizz to automate cashflow forecasting and deliver personalised business intelligence dashboards for each of its corporate clients. By enabling secure, self-service data uploads, every client gained access to real-time, tailored insights based on their unique transaction history, delivered with full compliance and enterprise-grade data governance.

-

A leading global waste management company reduced the scope and duration of its data migration and integration project by over 70%, accelerating delivery by a factor of four. By leveraging MLVizz, the organisation eliminated its reliance on high-cost data engineers and analyst, streamlining operations and significantly cutting project costs.

-

A national insurance provider utilised the MLVizz Data Quality Module to audit and assess internal systems, rapidly identifying inconsistencies and invalid customer records across multiple platforms. This enabled targeted data cleansing efforts, improved customer experience, and enhanced system integrity across departments.

-

A leading financial institution leveraged MLVizz to automate the complex data migration process during a major acquisition. Instead of relying on manual data mapping across multiple legacy systems, MLVizz streamlined and accelerated the entire migration, reducing both time and cost by over 50%.

By replacing a traditional team of 50 data engineers and analysts with just 10 key personnel, the institution delivered the program significantly faster, with fewer resources and minimal risk—enabling a smoother, more cost-effective integration.

-

An insurance provider integrated MLVizz with their Snowflake Data Lake, enabling internal teams to access real-time insights through MLVizz’s natural language AI chat interface. This gave staff GPT-style conversational access to their own internal systems—allowing non-technical users to query complex datasets, uncover insights instantly, and make faster, data-driven decisions without needing analysts or SQL.

-

Before adopting MLVizz, a major insurance company relied on manual processes to identify abnormal or potentially fraudulent transactions—resulting in delays and missed patterns. By implementing MLVizz’s agentic AI anomaly detection, the company was able to instantly surface irregularities across vast datasets without writing a single line of code. This dramatically improved fraud detection speed, accuracy, & operational efficiency.